According to a report by DappRadar, the number of active addresses on the Ethereum network increased by 27% over the past week, while trading volume surged by more than 40%. Meanwhile, BNB Chain saw a decline in active users by 15%, and the TON network experienced a 35% decrease. These figures demonstrate that activity on the Ethereum network continues to grow steadily, despite overall market trends.

The main driver behind this growth is the increase in trading volumes on decentralized exchanges (DEX) that use the Ethereum network. For instance, UniSwap reported a 33% rise in trading volume, reaching $5.4 billion, while Curve saw an even more significant jump with a 143% increase. This highlights the ongoing demand for DeFi applications built on Ethereum’s technology.

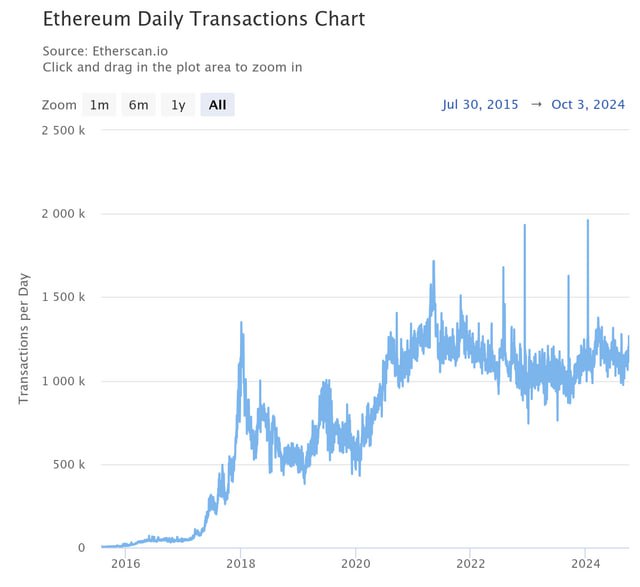

According to EtherScan statistics, the average number of daily transactions on the Ethereum network in October reached 1.266 million, exceeding the numbers recorded in September. This points to a continuous rise in network usage, regardless of potential market fluctuations in Ethereum’s price.

The growth in Ethereum network activity lays the groundwork for a potential change in ETH’s price. Typically, increased blockchain activity precedes a rise in the value of the underlying digital asset. Currently, Ethereum aims to break through the $2,650 level. If successful, this could pave the way for further growth to $2,800 and beyond.

Experts note that this surge in activity could signal a shift in market sentiment toward Ethereum for investors and traders.