An unknown trader managed to turn an initial $125,000 investment into over $43 million by investing in Ethereum, the second-largest cryptocurrency by market capitalization. This impressive result caught the attention of analysts from Lookonchain.

The Path to Profit: From $125,000 to $43 Million

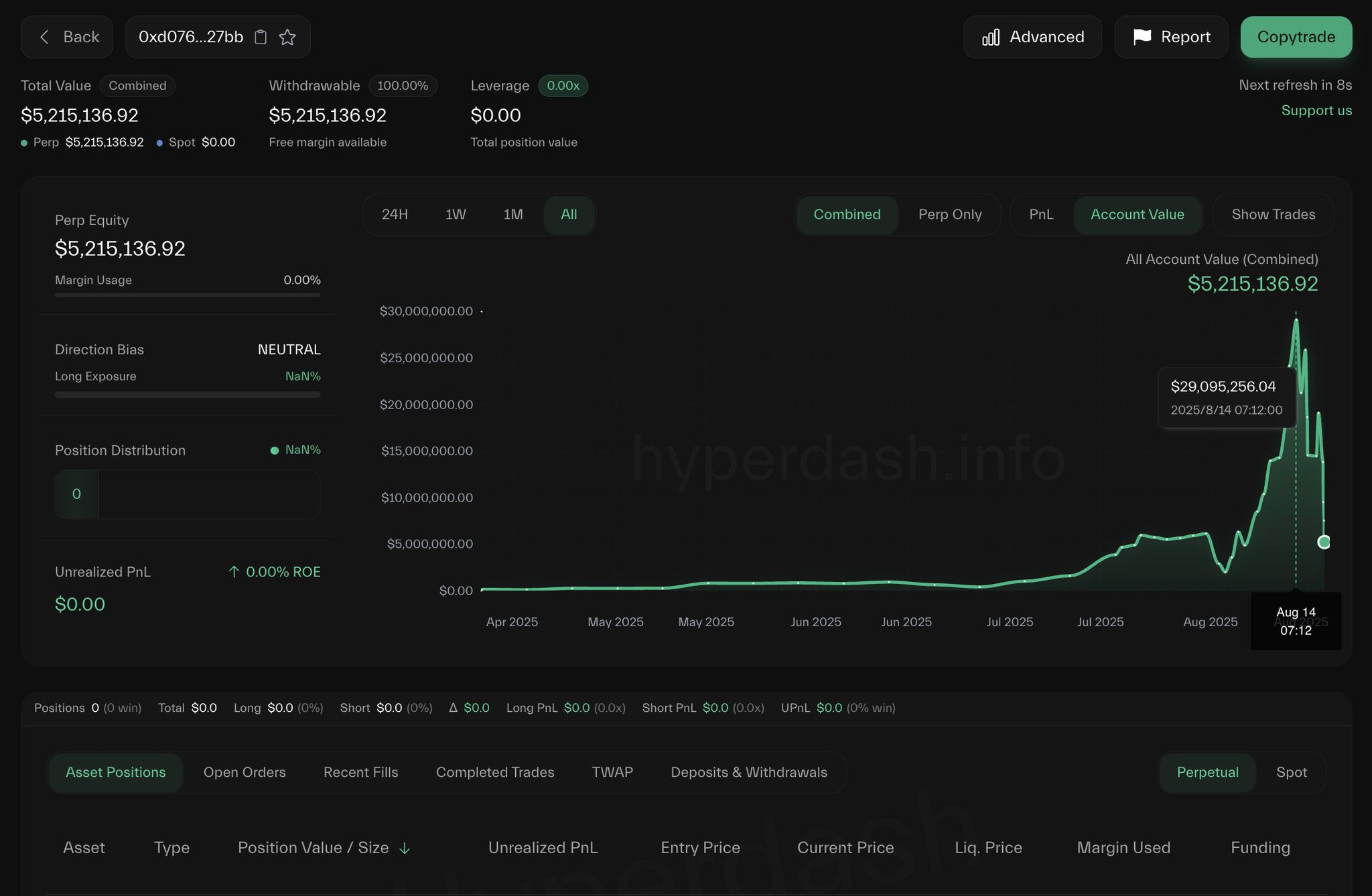

In May, the trader made his first move by transferring $125,000 to the decentralized exchange Hyperliquid. Over the course of four months, he consistently opened long positions and “reinvested every dollar,” which significantly increased his capital. At one point, his portfolio reached a record $303 million.

On August 18, after Ethereum’s price dropped, the trader closed 66,749 long positions, locking in a profit of $6.86 million. At its peak, his capital was valued at over $43 million. The price of Ethereum at the time of closing positions was $4328, which, according to CoinGecko, had dropped by 4.6% over the past 24 hours.

Ethereum Price Forecast: What’s Next?

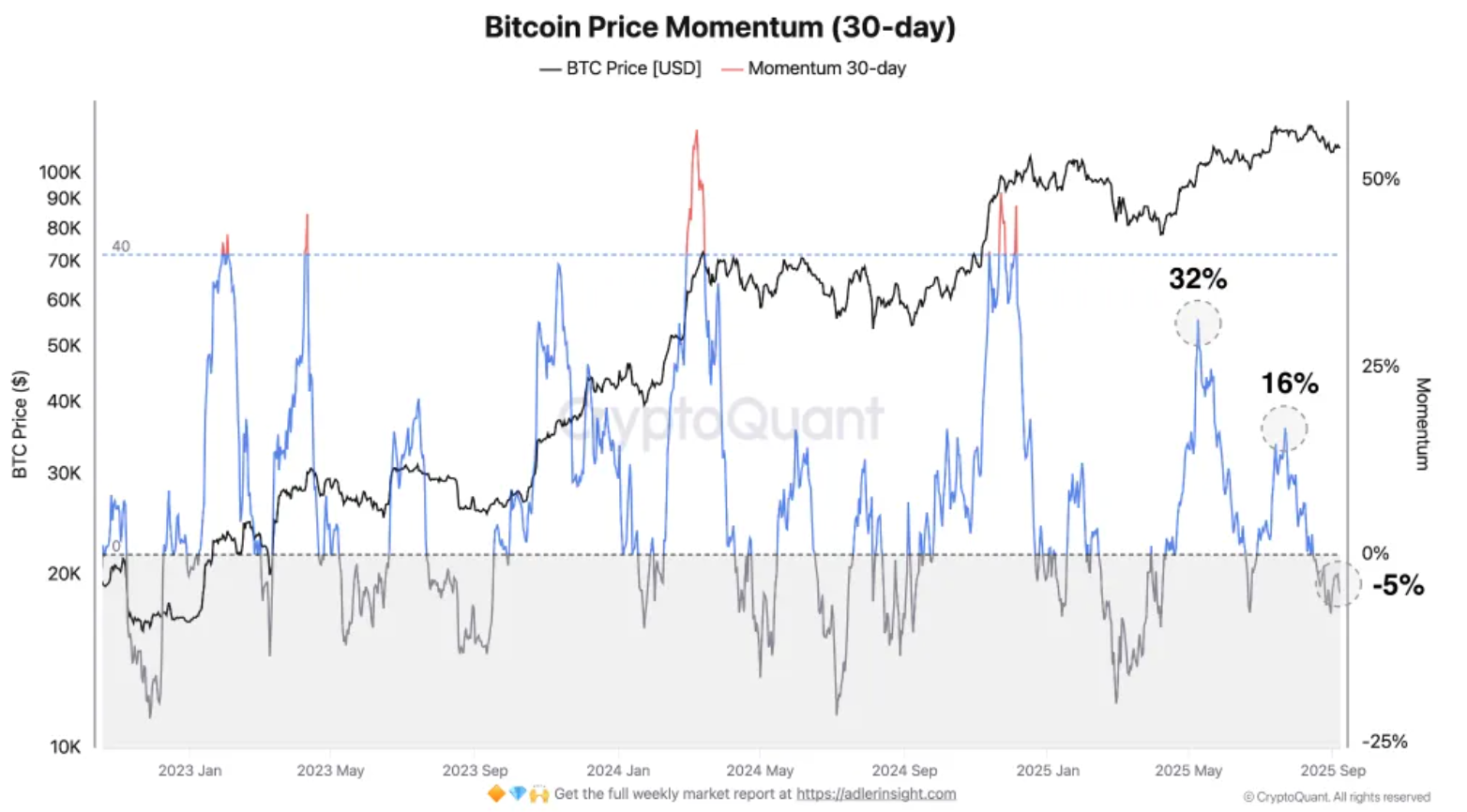

Analysts believe Ethereum’s future depends on further price fluctuations. Crypto trader Cipher X suggests that if the price falls to $4200, long positions worth up to $2 billion could be liquidated. On major exchanges like Binance, OKX, and Bybit, the total liquidation volume at this level could reach $52.18 million, $21.56 million, and $23.59 million, respectively.

“Breaking the $4200 mark could trigger a cascade of forced sales, leading to further price declines,” says Cipher X.

Meanwhile, analyst Lennart Snyder believes Ethereum has established itself above the crucial $4000 resistance level. He adds that any movement above $3490 would confirm the bullish trend. “Establishing $4000 as support would be an extremely bullish retest,” he notes.

Currently, Ethereum’s support levels are around $4240-4190, while resistance lies at $4550-4571. Snyder also highlighted $4780 as the upper boundary, noting that a price increase above this level would open the way to $5000.

Institutional Interest in Ethereum: Sustainable Demand

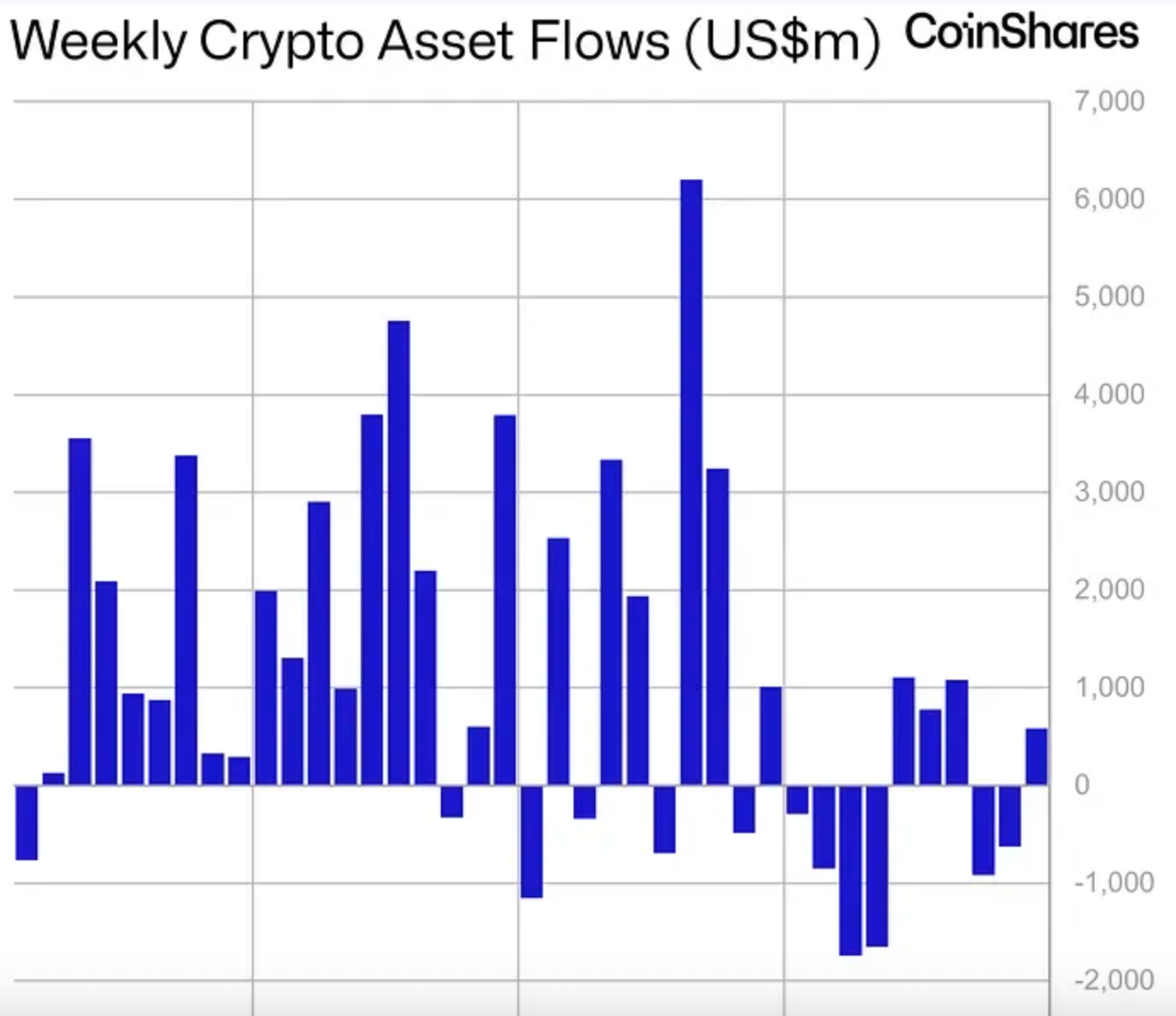

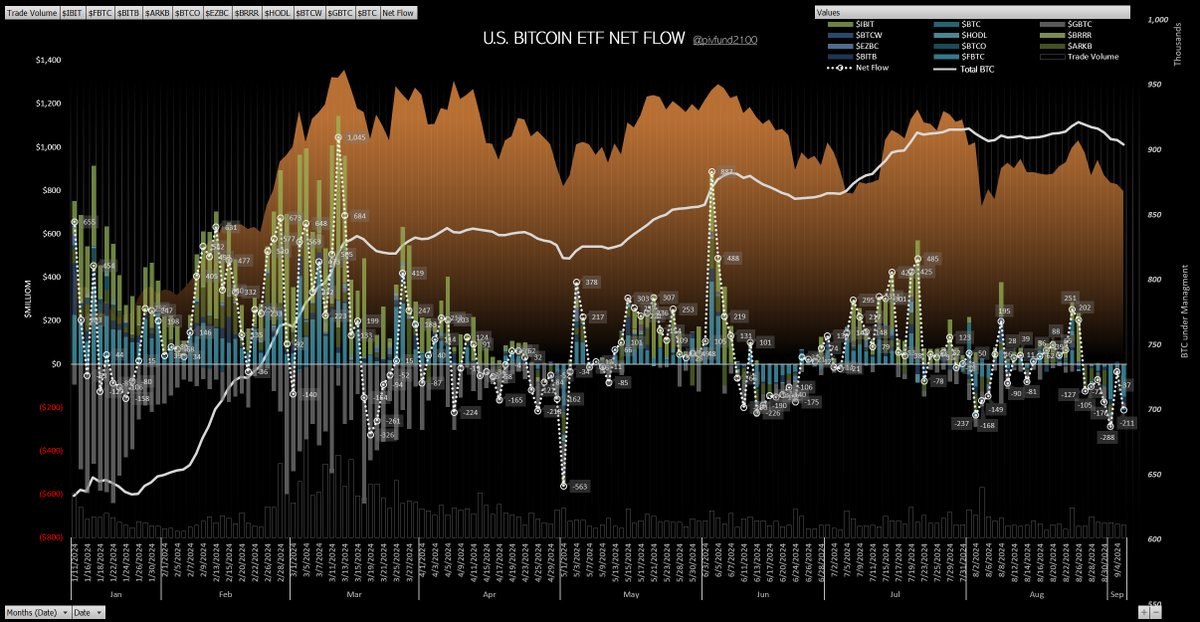

Institutional investors are also actively supporting Ethereum. As reported by Standard Chartered, one of the factors behind the cryptocurrency’s growth is steady inflows into ETFs and increased demand from corporate treasuries.

From August 9 to 15, Ethereum-based exchange-traded funds (ETFs) attracted a record $2.8 billion, with the total trading volume of these instruments reaching a historic high of $17 billion.

Bloomberg analyst Eric Balchunas commented: “Ethereum truly woke up in July. It was as if it had slept for 11 months and then packed a year’s worth of activity into six weeks.”

Meanwhile, public companies have continued accumulating Ethereum. Currently, their holdings exceed 4 million ETH, equivalent to $17.6 billion, or 3.38% of the total supply of the cryptocurrency. For instance, BitMine Immersion purchased 373,000 ETH, raising its balance to 1.52 million coins worth $6.5 billion. This makes it the largest Ethereum treasury and the second-largest globally, trailing only Strategy, which holds 628,946 BTC worth $74 billion.

The Future of Ethereum: Hopes and Risks

BitMine remains confident that Ethereum will become one of the key macro-investments over the next 10-15 years. “The transition of Wall Street and AI to blockchain should lead to a massive transformation of the financial system, and much of this process will happen within the Ethereum ecosystem,” said Tom Lee, Chairman of the Board at BitMine.

However, the trend of corporate crypto treasuries has sparked some debate within the crypto community. Proponents believe such structures increase the visibility of the ecosystem and create long-term value for the assets that companies accumulate. Critics, on the other hand, point to the potential risk of conflicts of interest.

Conclusion

The story of a trader who turned $125,000 into $43 million is a shining example of how skillful risk management and investment strategies can lead to substantial profits in the cryptocurrency markets. However, like any investment field, success requires attentiveness and the ability to adapt to rapidly changing market conditions.