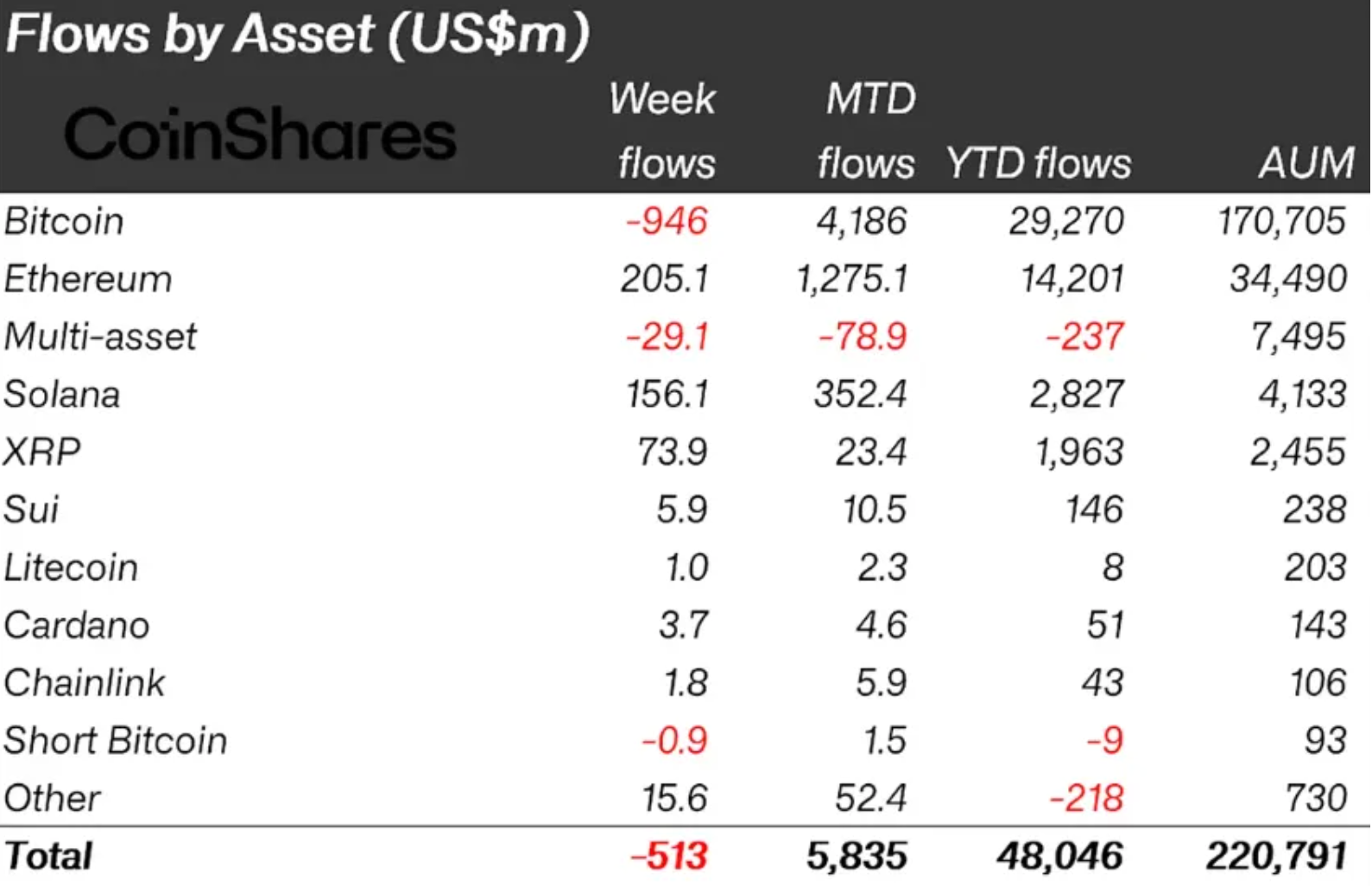

Between October 10 and 17, the cryptocurrency market faced a significant capital outflow — a total of $513 million was withdrawn from digital asset investment products, according to a weekly report by CoinShares. Analysts attribute the decline in inflows to liquidity issues at major exchange Binance, reported on October 10. Despite the short-term turbulence, many investors viewed the dip as a buying opportunity, particularly in the altcoin segment.

Major Outflows in the U.S., While Europe and Canada Accumulate Positions

CoinShares data shows that the United States accounted for the largest share of outflows, with investors pulling $621 million from crypto products. This marks the biggest weekly withdrawal since mid-year and reflects growing caution among U.S. institutional investors amid ongoing regulatory uncertainty and liquidity risks.

In contrast, investors in Germany, Switzerland, and Canada took advantage of lower prices to increase exposure to digital assets. Net inflows in these regions reached $54.2 million, $48 million, and $42.4 million, respectively.

Bitcoin Loses Capital but Remains the Market Leader

Bitcoin (BTC) was the only major asset to record a net outflow last week. Investors withdrew $946 million from Bitcoin-based products, likely taking profits after strong gains in September and early October.

Despite this setback, total inflows into Bitcoin investment products since the start of 2025 remain positive, reaching $29.3 billion. However, this figure is below last year’s level of $41.7 billion in 2024, suggesting a temporary cooling of institutional interest and a reallocation of capital toward other assets.

Ethereum Back in Focus with $205 Million in New Inflows

As prices fell, investor attention shifted to Ethereum (ETH). Investment products based on the second-largest cryptocurrency saw $205 million in inflows over the week. Analysts attribute this rebound to investors buying the dip and renewed optimism about liquidity recovery, as well as anticipation of potential spot Ethereum ETF approvals in several key markets.

This renewed interest underscores Ethereum’s growing role as a leading asset in the institutional crypto space.

Altcoins Gain Momentum Amid ETP Launch Expectations

Investors also turned their attention to Solana (SOL) and XRP, driven by expectations surrounding the launch of new exchange-traded products (ETPs) for these assets. Over the past week, Solana-based funds attracted $156 million, while XRP-based products received $73.9 million.

According to CoinShares, Solana and XRP were the main beneficiaries of capital rotation within the crypto market. Solana continues to gain traction thanks to the rapid growth of its DeFi ecosystem, while XRP remains supported by positive sentiment following Ripple’s partial legal victories and ongoing expansion in cross-border payment use cases.

Market Activity Remains Strong

Despite the overall capital outflow, trading activity in crypto ETPs remained robust. The total weekly trading volume reached $51 billion, signaling sustained investor engagement and high market volatility.

By comparison, in the previous week — October 4 to 10 — investors poured $3.17 billion into crypto products, illustrating the short-term and reactive nature of market flows.

Broader Context: Liquidity Pressure and Regulatory Uncertainty

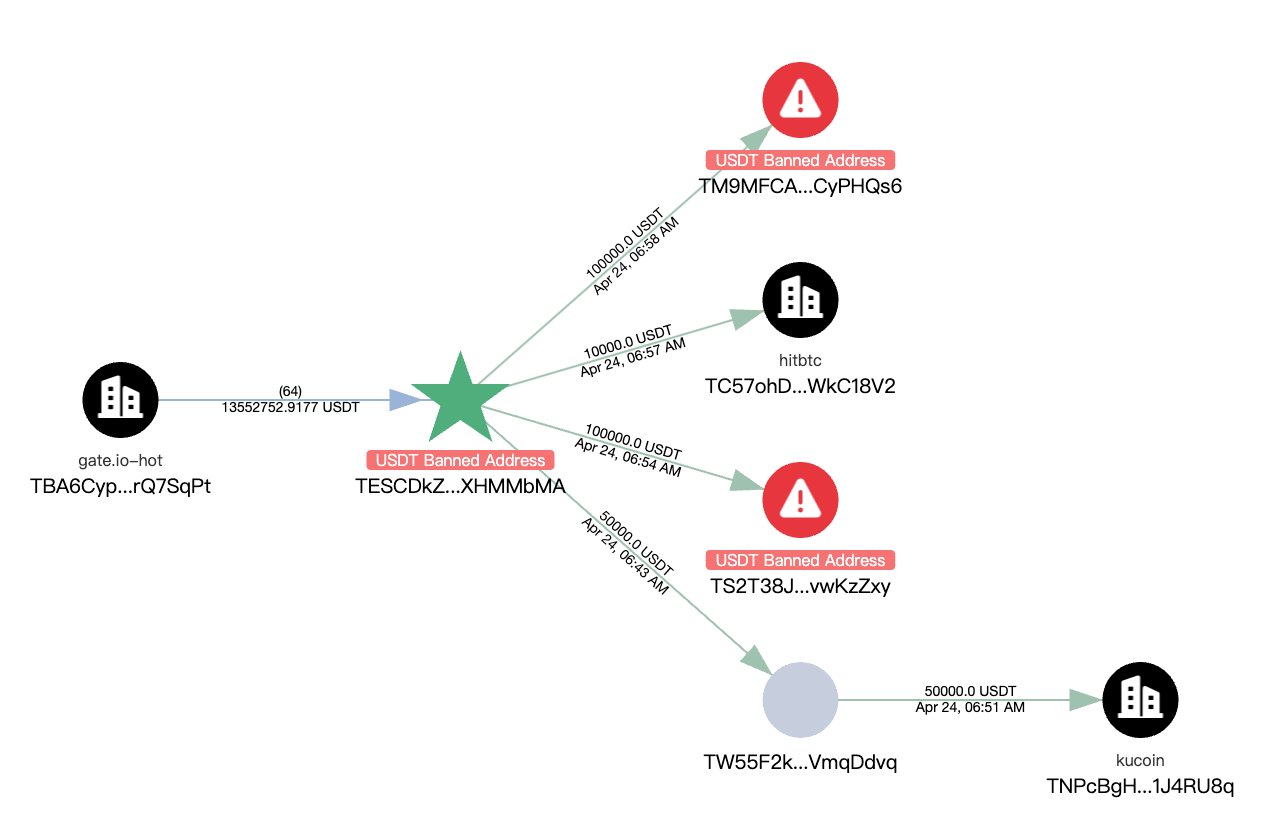

The liquidity disruptions on Binance, which triggered the outflows, temporarily slowed trading activity and widened spreads across major trading pairs. In response, some institutional investors chose to reduce exposure and wait for market stability.

Nevertheless, the market remains fundamentally resilient. The continued inflows into Ethereum, Solana, and XRP products demonstrate that investors are still seeking diversification opportunities, even amid volatility and macroeconomic headwinds.

Conclusion

The $513 million weekly outflow does not signal a mass exodus from the crypto market. Instead, it highlights a shift in investor focus from Bitcoin to altcoins, led by Ethereum and Solana. If institutional demand for these assets continues to grow, the crypto market could see a renewed wave of capital inflows by late October.