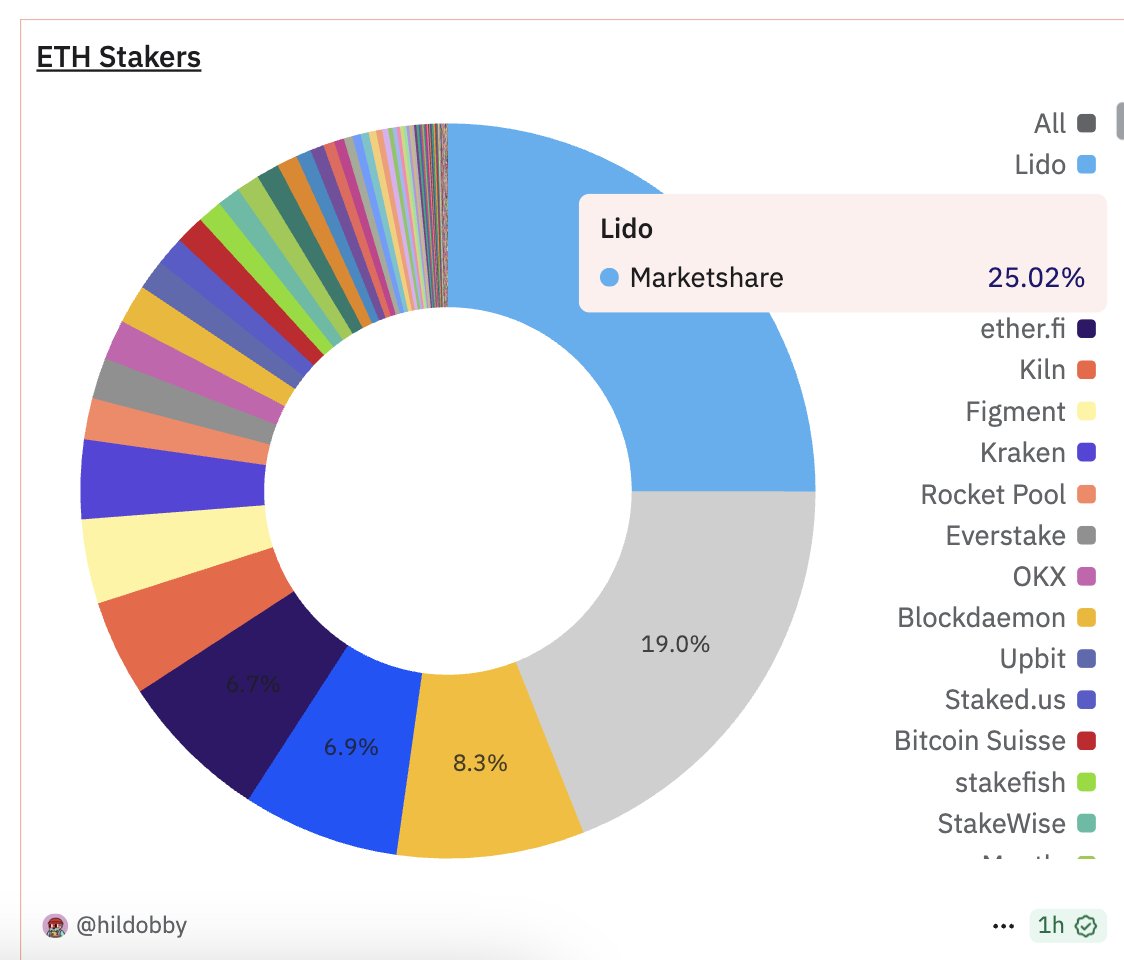

Lido Finance, once the dominant force in Ethereum staking, has seen its market share drop to 25%—its lowest level since March 2022. The data was highlighted by Tom Wan, an analyst at Entropy Advisors. Just in February, Lido held a 32% share, which declined to 29.6% by March, signaling a 5% drop over the past six months.

A More Fragmented Market

The decline reflects a broader trend toward decentralization in the staking ecosystem. While Lido remains the largest single player, other participants are gaining traction. Centralized exchanges Binance (8.3%) and Coinbase (6.9%) currently round out the top three.

Notably, 19% of validators remain unidentified. According to Wan, these could be either solo stakers or institutional players who choose not to disclose their wallet addresses for privacy or strategic reasons.

Record-High Deposits Followed by Capital Outflows

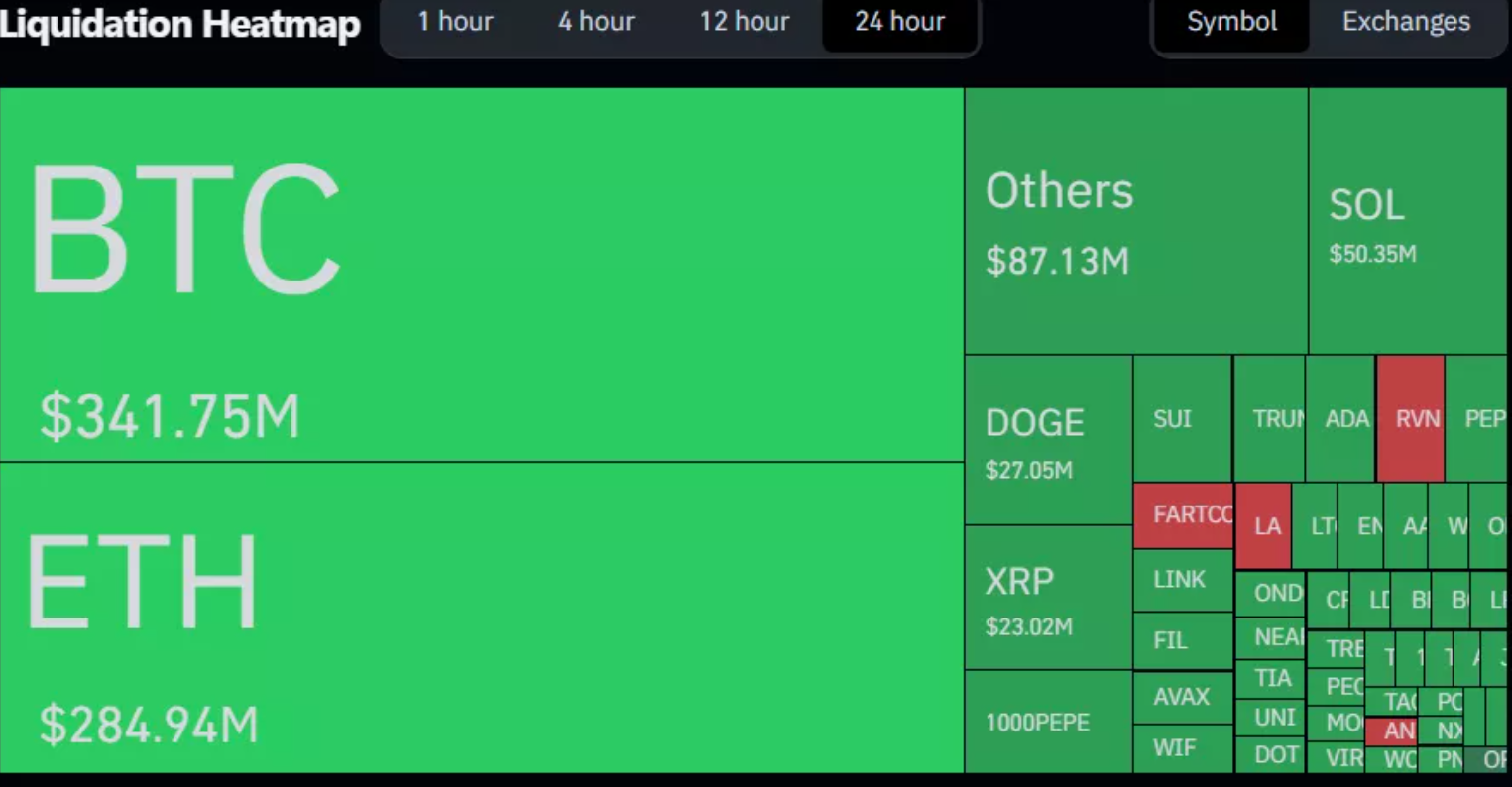

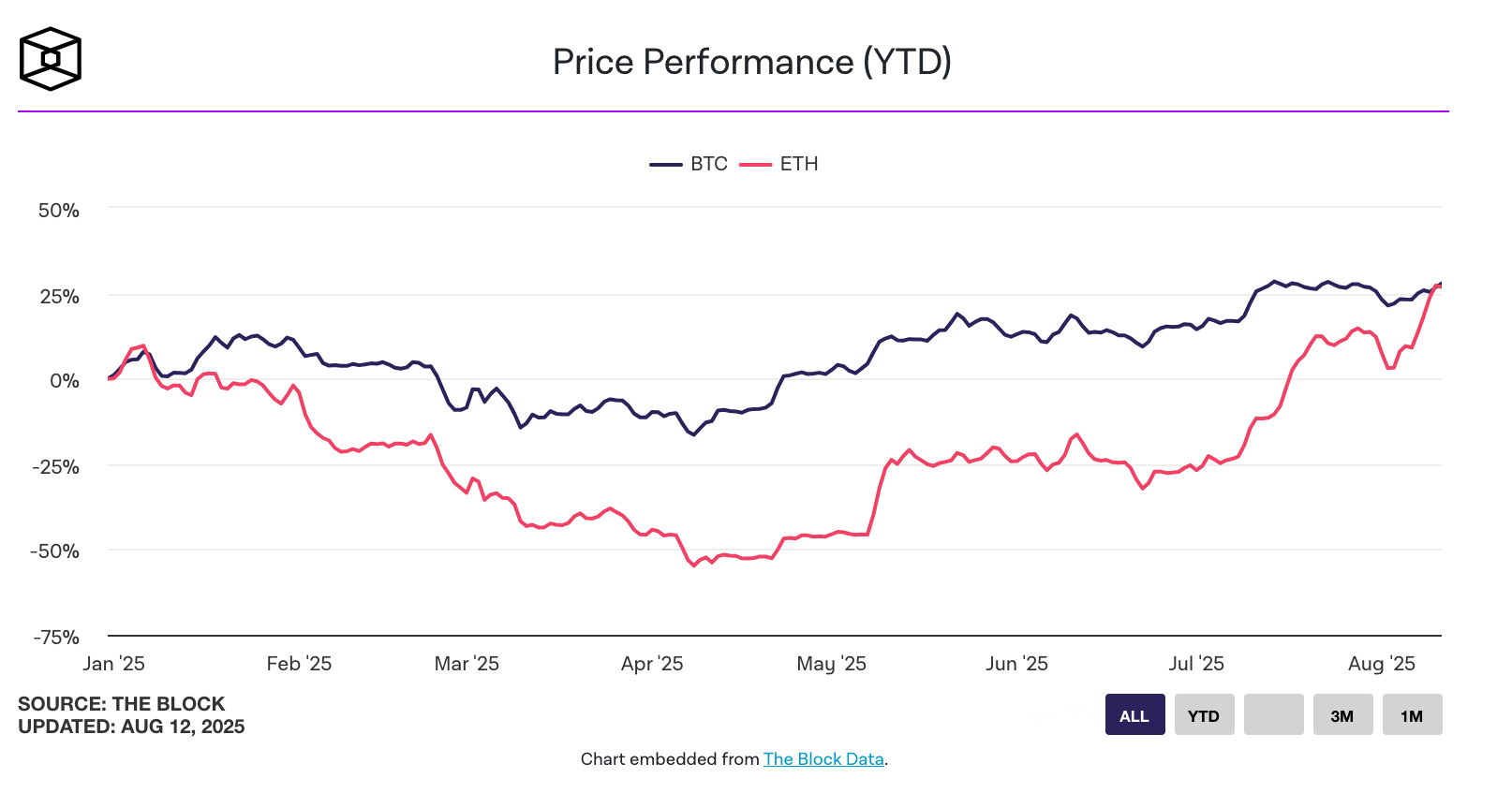

On July 16, the total ETH staked reached an all-time high of around 36.5 million ETH. However, that number declined to 36.1 million ETH shortly after. Lido led in terms of net outflows over the past month, putting additional pressure on the platform.

At the same time, the exit queue for validators surged from 1,920 to over 475,000 in just one week. The waiting period for exiting the network also jumped to nine days. Galaxy Digital Research attributes this spike to the recent Pectra upgrade, which introduced stricter technical requirements, and a chain reaction within the Liquid Staking Token (LST) market.

Aave Lending Crisis Disrupts Looping Strategies

One of the main destabilizing factors has been a sharp drop in ETH supply on Aave. A major wallet, reportedly linked to the HTX exchange, withdrew a large amount of ETH causing WETH lending rates to spike from 2% to 18% in a matter of days.

This rate hike rendered popular leverage-based “looping” strategies unprofitable. In such strategies, users borrow ETH using LST or LRT assets as collateral, then restake the borrowed funds to amplify returns. The mass unwinding of these positions contributed to the temporary depegging of Lido’s stETH from ETH.

Marc Zeller, co-founder of Aavechan, confirmed that the rise in Aave’s utilization ratio was linked to the large withdrawals, but said that conditions are already stabilizing. Borrowing rates are returning to normal levels, which could help restore confidence in leveraged staking strategies.

Conclusion

Lido’s declining share and the recent market volatility point to a rapidly shifting landscape in Ethereum staking. As competition intensifies and new technical and economic dynamics come into play, both platforms and investors will need to adapt to a more complex and evolving environment.