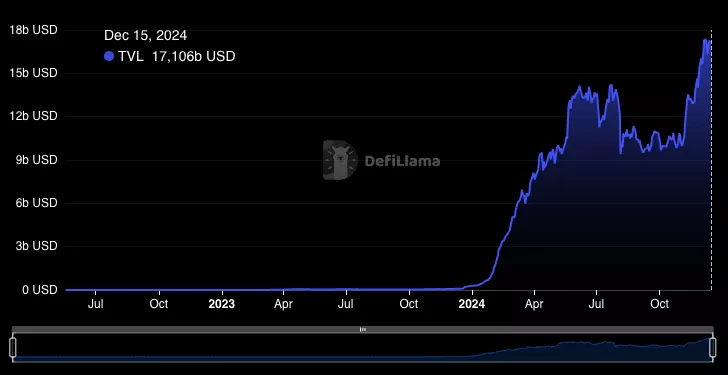

In 2024, the total value locked (TVL) in Ethereum liquid restaking protocols surged from $284 million to $17 billion — a growth of nearly 6000%.

The leading protocol is Ether.Fi, with a TVL of $9.1 billion. It is followed by Kelp ($1.8 billion), Eigenpie ($1.6 billion), and Renzo ($1.4 billion). The increasing interest in restaking highlights growing trust in these technologies, despite risks of potential detachment from the underlying asset and yield crises.

Nevertheless, liquid restaking still lags behind traditional Ethereum staking, where the total TVL exceeds $53 billion.

According to Dune, as of the time of writing, 34.4 million ETH is locked in Ethereum staking, worth about $133 billion, representing 28.1% of the total ETH supply.

For comparison, on December 12, the TVL in the Bitcoin staking protocol Babylon reached $3.63 billion. This growth underscores the increasing adoption of innovative tools to enhance yield within blockchain ecosystems.