The Ethereum Foundation team has released its first report as part of the Trillion Dollar Security initiative, where researchers have highlighted six key areas that require significant improvements to ensure the security of the network in the future. This isn’t just another vulnerability analysis — it’s a call to collaborate in finding solutions that can support the growing interest in the blockchain space.

Overall Threats to the Ethereum Ecosystem

Currently, the Ethereum ecosystem supports a capital of over $600 billion, but for Ethereum to become a platform where billions of dollars are stored and used, significant improvements must be made. Ethereum’s ambitions are to create a reliable, secure, and accessible environment where billions of people can store assets on the blockchain, and companies and institutions can trust smart contracts with trillions of dollars.

To achieve this goal, the Ethereum Foundation has identified several areas that need to be addressed first:

User Experience Issues

Security begins with how users interact with the network. Issues with wallet and app interfaces often lead to mistakes that can be catastrophic for users. In particular, users are often unaware of the risks associated with storing their private keys and seed phrases. Avoiding secure storage methods (e.g., hardware wallets) leaves the data vulnerable.

Key Issues:

- Seed Phrase Storage Errors — Users often write them down on paper or store them in the cloud, making them accessible to third parties.

- “Blind Signing” of Transactions — Wallets often display incomplete information about transactions, leading to phishing and fraud risks.

- Lack of Restrictions for DeFi Apps — Permissions granted indefinitely can lead to asset theft, even after a long period.

Smart Contract Security Issues

Smart contracts have become an integral part of Ethereum, but their code can contain vulnerabilities that open wide opportunities for attacks. Despite progress in security, attackers can exploit errors, especially if contracts allow updates after deployment.

Key Risks:

- Re-entrancy Attacks — Allow attackers to manipulate contracts and steal funds.

- Using Untrusted Libraries — Code errors in libraries can create vulnerabilities across the entire system.

- Access Control Errors — If access to contract functionality is not restricted, attackers can exploit vulnerabilities to steal assets.

There are also difficulties because developers do not always use secure practices by default, and formal code verification remains a complex and rarely used process. Recent studies also highlighted a new risk — bugs introduced by tools that automatically generate code using AI.

Infrastructure and Cloud Security

Ethereum relies heavily on centralized services, such as RPC nodes, L2 networks, and cloud providers like AWS and CloudFlare. This creates risks associated with potential failures or censorship from these services, which could limit users’ access to the network.

Risks Related to Centralized Infrastructure:

- Failure or Censorship by Cloud Providers — Can lead to significant disruptions in the network’s operations.

- Layer 2 Risks (L2) — Bridges, errors in proof systems, and centralization through “security councils” create new vulnerabilities.

Consensus-Level Risks

The Ethereum consensus protocol has proven its reliability, but long-term threats remain. Among these are the concentration of staking with a few large providers, which creates risks for centralization of control and potential censorship of transactions.

Issues:

- Staking Centralization — A few large providers, such as Lido, can establish dominance in network management, making the system vulnerable to censorship.

- Lack of Social Slashing Mechanism — The absence of clear rules for punishing validators who attack the network leads to risks.

The Quantum Computer Threat remains a long-term issue, as they could break the existing cryptographic algorithms of Ethereum.

Incident Monitoring and Response

When an attack occurs, the ecosystem faces coordination problems. The need for quick response in incidents may be hindered by the lack of a centralized mechanism for interacting with hacked platforms and projects.

Social Layer and Governance

The social layer includes people, organizations, and processes that influence Ethereum’s development. It involves long-term risks such as:

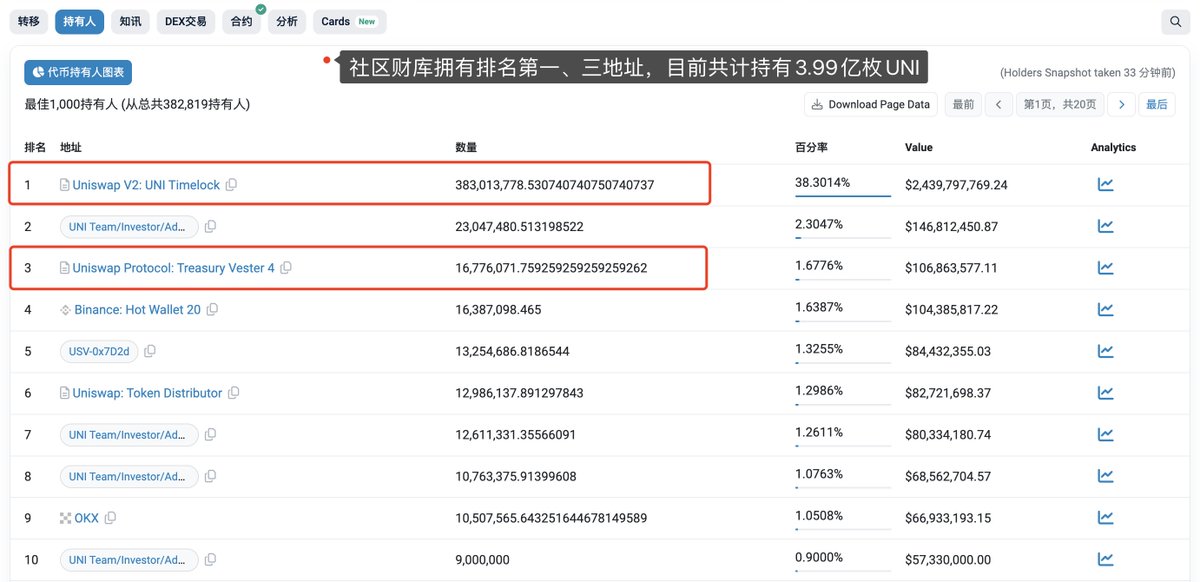

- Staking and Asset Centralization, backed by real-world assets, can give issuers significant influence over the network.

- Regulatory Pressure could undermine Ethereum’s independence, leading to commercialization and centralization, thus undermining the protocol’s neutrality.

Steps for Addressing Issues

Based on the findings of this report, the Ethereum Foundation, together with the community, plans to develop a strategy to tackle the most critical issues. Among the proposed steps are improving smart contract security tools, enhancing the user experience, and creating more reliable consensus control mechanisms.

Call for Collaboration:

The Ethereum Foundation invites the community to contribute their ideas and solutions to ensure the future of a network that can support not only billions of users but also trillions of dollars in assets.

Further details of the report are available for all interested parties, and the Ethereum Foundation is open to ideas that will help make the blockchain network more secure and accessible.