Historical Context

In August 2025, Ethereum (ETH) showed an impressive 25% growth, reaching a new all-time high above $4867. For the second-largest cryptocurrency by market capitalization, this marked a significant milestone, as the market had long awaited a breakout to record levels.

However, crypto analyst CryptoGoos warns that September has historically been an unfavorable month for Ethereum. Since 2016, ETH has only ended August in the green three times, and each time September brought a correction of 12–21%.

The examples speak for themselves:

- in August 2017, ETH surged 92% but dropped 21% in September;

- similar patterns occurred in 2018 and 2021;

- autumn corrections have traditionally been seen as a cooling-off period after summer rallies.

Could 2025 Be an Exception?

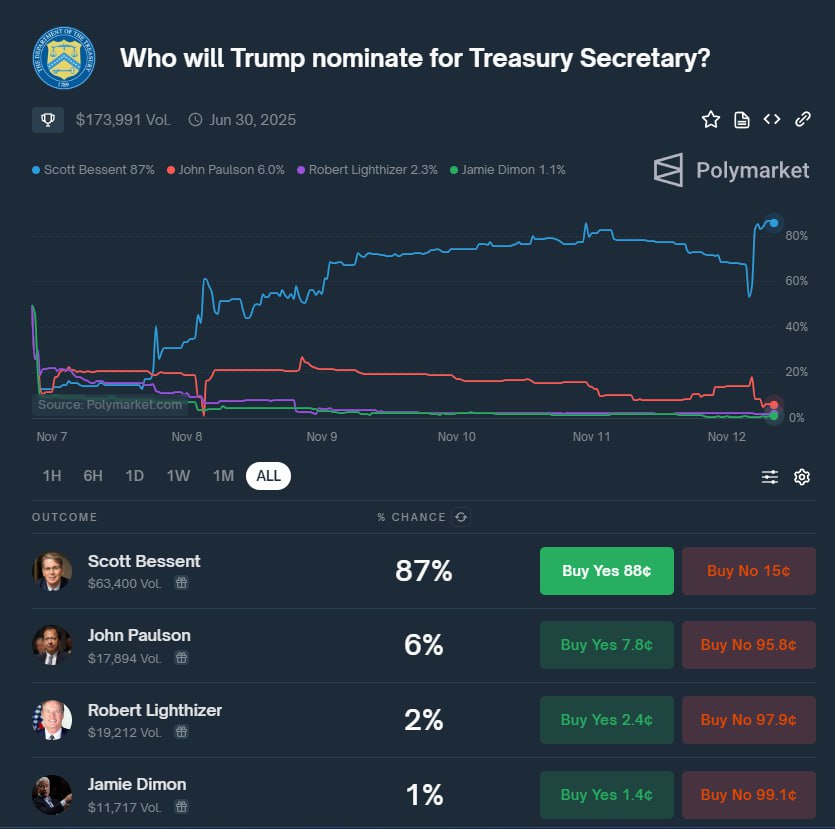

Despite the concerning statistics, many market participants note that the current cycle is developing under unique conditions. The key difference is the large-scale involvement of institutional investors, which has never been seen at this magnitude before.

The Role of ETFs

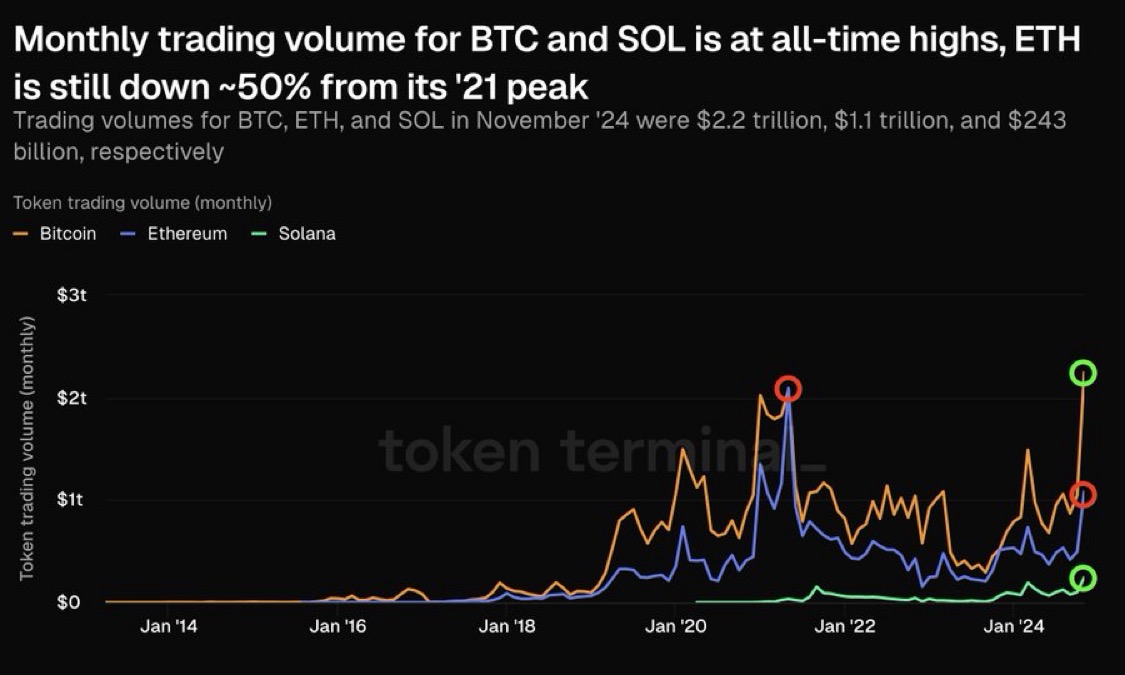

In August, spot Ethereum ETFs attracted $2.79 billion, while Bitcoin-based funds recorded net outflows of $1.2 billion. This signals a shift in investor interest from “digital gold” toward Ethereum, which is increasingly viewed as the next-generation asset.

Corporate Treasuries

Another factor impacting supply is ETH accumulation by large corporations. In total, corporate treasuries hold 4.1 million ETH (about $18.7 billion).

The leader is BitMine Immersion Tech, with more than 1.5 million ETH valued at $6.9 billion.

Altogether, institutional investors and ETFs now control almost 9% of Ethereum’s total supply, giving “big players” significant influence over market dynamics.

Capital Flowing Out of Bitcoin

Interestingly, the latest Ethereum rally coincided with capital flowing out of Bitcoin. Large BTC holders started taking profits and reallocating funds into ETH. This reflects a shift in market focus: Ethereum is increasingly seen not just as an alternative to Bitcoin, but as a more promising asset due to its technological foundation and the growth of the DeFi sector.

Conclusion

Historical patterns suggest that September could bring a correction for Ethereum. However, for the first time in its history, ETH faces massive institutional demand. If inflows into ETFs continue and corporations keep accumulating the asset, Ethereum may break the long-standing seasonal trend and solidify its position as the new “center of gravity” in the crypto market.