After a lengthy approval process, spot ETFs on Ethereum have finally started trading on traditional stock exchanges.

Crypto investors have anticipated this event for several years, hoping that ETFs would lead to a significant influx of liquidity into ETH and an increase in its value.

However, will this actually happen? Let’s compare the situation with BTC:

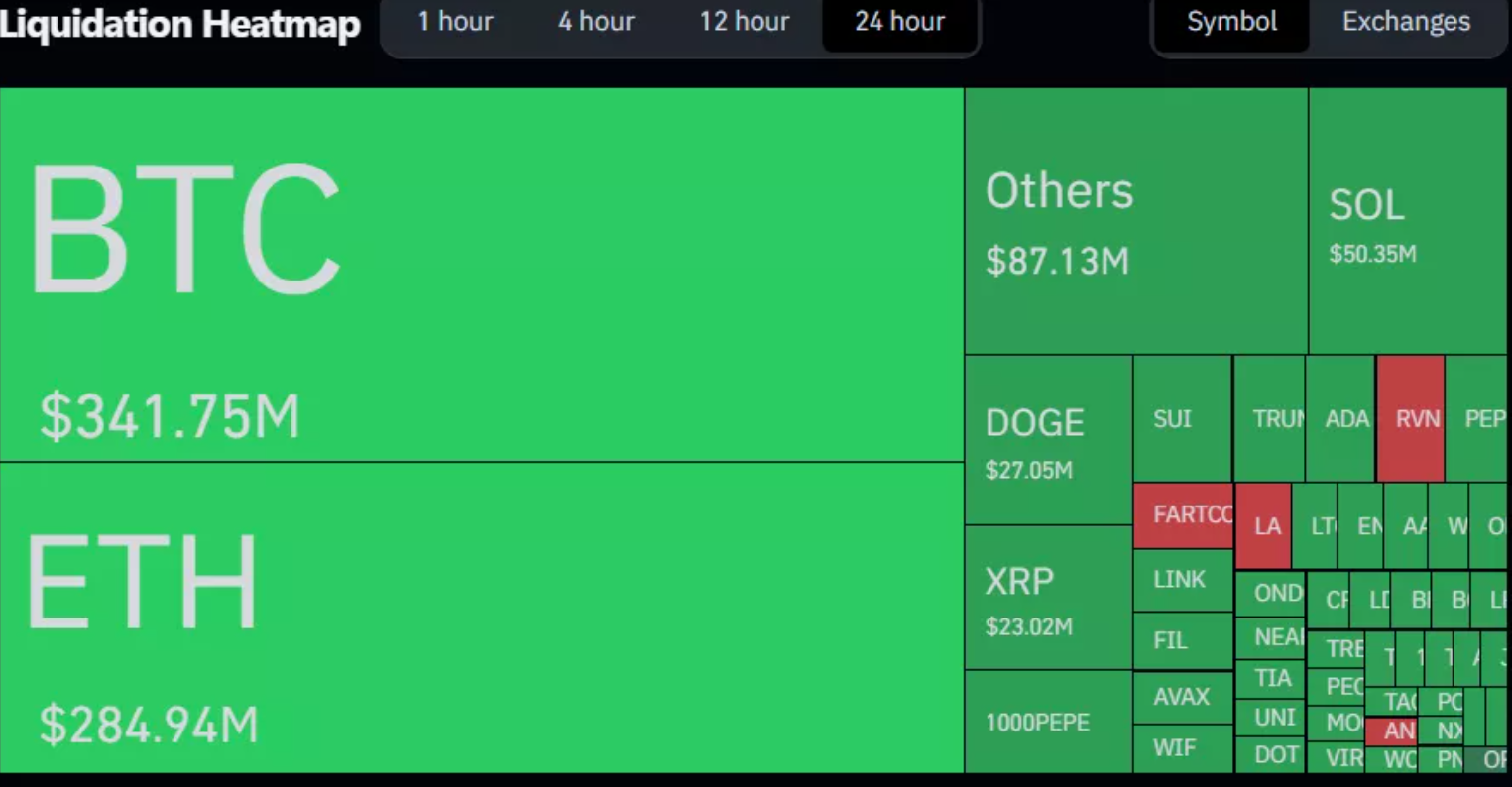

The recently launched spot BTC ETFs at the beginning of the year became some of the most popular financial products, drawing $18.6 billion in outflows from Grayscale’s GBTC and accumulating an additional $17 billion.

For example, BlackRock’s IBIT Bitcoin fund ranked 4th among all ETFs in terms of inflows since the beginning of the year.

Although Bitcoin ETFs attracted significant sums, expectations were not fully met:

- Institutional investors, such as pension funds, did not show much interest.

- The primary buyers were investment advisors and hedge funds, not new major players.

- Despite the rise in Bitcoin’s price, it significantly lags behind the leading stocks in the market.

What conclusion can be drawn?

The growth of BTC in the first half of this year is more likely associated with general market optimism rather than solely with ETFs.

ETFs are just one of the factors influencing the long-term value of BTC and ETH. Moreover, the Ethereum ETF does not include staking rewards, which automatically excludes a significant audience.

In the short term, the ETF is more likely to serve as a marketing tool. The approval of the ETF should attract attention to Ethereum in the coming months as issuers actively promote their products, and investors seek information about the blockchain that aims to replace the traditional financial system.

For example, the CEO of BlackRock actively promotes tokenization on Ethereum, which could attract a new audience to this blockchain or its ETF.