According to analysts, the market has gone through the necessary stage of liquidations, and buyers are gradually regaining strength. They also note that after such a significant correction, price recovery may begin, especially if current macroeconomic conditions remain stable.

Experts base their assertion on two key indicators:

- The buyer-seller ratio for Ethereum on exchanges has turned positive again, indicating increased buyer interest and the potential for price recovery.

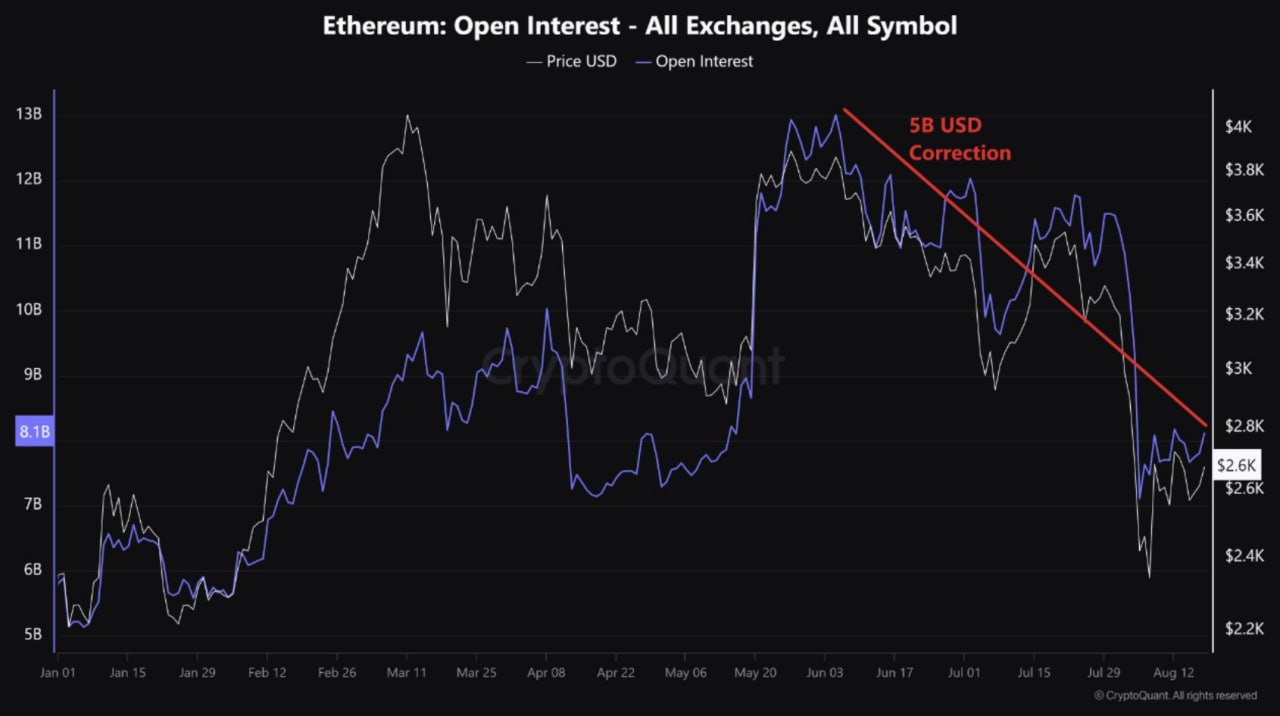

- The dynamics of open interest (OI), which is an important indicator of market sentiment.

“In June 2024, when Ethereum reached $3,800, open interest surged to a record $13 billion, signaling a possible correction. And indeed, it occurred: by August 5, OI had dropped to $7 billion,” the report states.

Additionally, analysts emphasize that the current situation in the Ethereum market resembles previous correction phases, after which recovery and growth periods followed. Therefore, they advise traders and investors to closely monitor the situation and not miss potential entry points into the market.