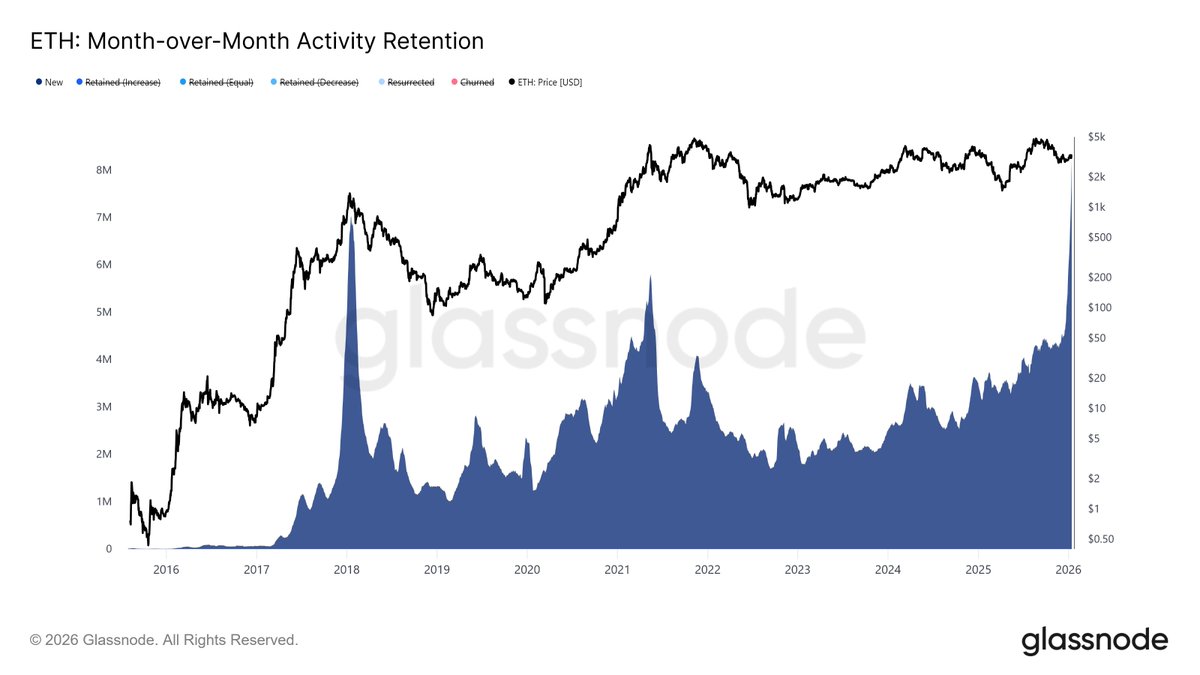

Since 2021, Ethereum has had an automatic mechanism for burning ETH with every transaction, which continuously reduces the number of coins in circulation and positively impacts the value of each coin.

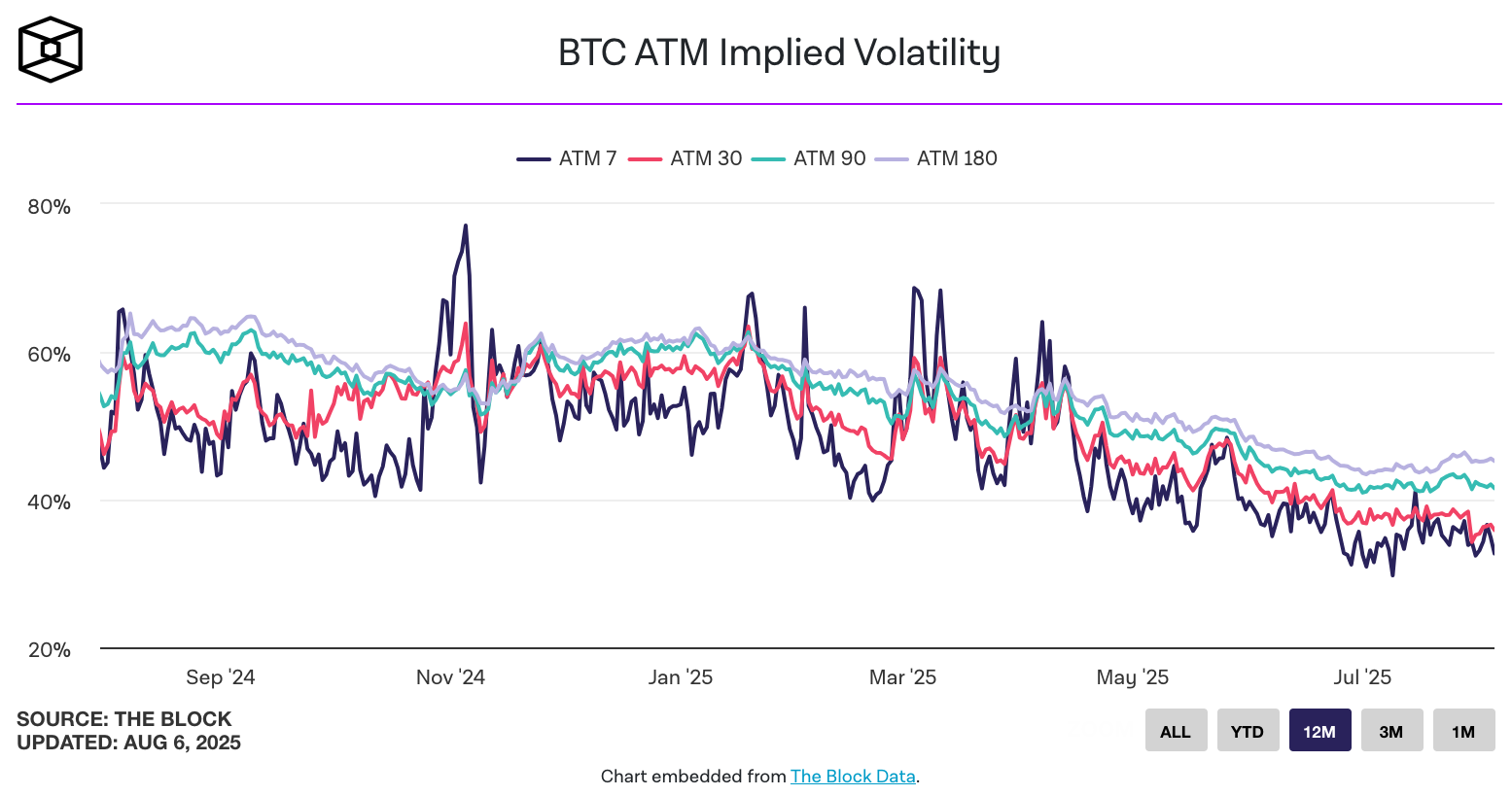

This mechanism is most effective during periods of high activity when the blockchain is congested, and transaction fees exceed $5-10.

Why has the burn rate decreased? Here are the two main reasons:

Summer is the period of the lowest activity in any financial market.

Due to the reduced demand for Ethereum, network fees have fallen to record lows. For example, on June 22, the average gas fee for Ethereum dropped to $1.34, the lowest since April 18, 2020.

The Dencun update.

Previously, L2 networks operating on Ethereum paid between $421,000 and $1 million daily to validate transactions on the Ethereum mainnet. The Dencun update significantly reduced the costs of operating L2 networks, so now Arbitrum, OP Mainnet, Base, and other L2 networks pay between $100 and $10,000 daily for Ethereum fees.

How will this affect the long-term value of Ethereum?

Demand for Ethereum has always been cyclical. Currently, activity is low, but it will increase as people return to the network, leading to a higher burn rate.

In any case, since Ethereum’s transition to PoS, the amount of ETH burned has always exceeded the amount “mined.” For instance, since September 2022, 1,433,985 ETH has been “mined,” while 1,726,376 ETH has been burned.