Investors are gradually reallocating capital towards Bitcoin, resulting in Ethereum’s market share dropping to 13.4%. This could indicate a shift towards more stable assets amid market uncertainty.

ETH is currently showing weakness, and the existing buyer support is insufficient to push the price toward the $3,000 mark. Furthermore, selling pressure remains high, which further limits the asset’s growth potential.

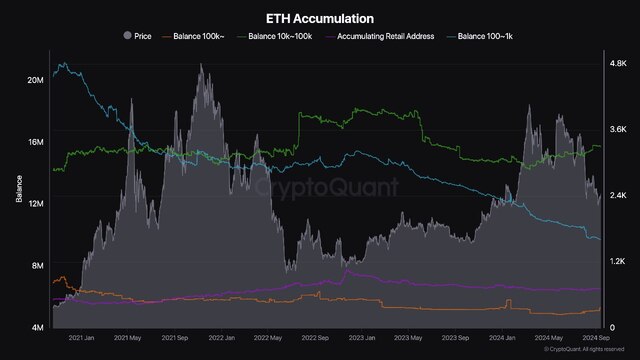

According to a CryptoQuant report, large holders with balances exceeding 100,000 ETH refrained from accumulating in August and September. This may suggest that institutional players are taking a cautious stance, waiting for more favorable market conditions.

Big players holding between 1,000 and 100,000 ETH continue to make purchases, but at a slow pace, reflecting a restrained sentiment. Meanwhile, medium-sized holders (100 to 1,000 ETH) have consistently been selling off their reserves, adding more pressure to the market and lowering the chances of a short-term recovery.

With whale activity currently at a low level, it is unlikely that the altcoin will resume a bullish trend in the near future. A return to growth would require both active buying from large players and an overall improvement in market conditions.