Previously, the main obstacle to launching an ETF on Solana (SOL) was regulatory issues, as the cryptocurrency and several others were classified as securities.

Today, the situation has changed: the SEC amended its lawsuit against Binance, no longer asserting that the exchange facilitated trading in “crypto asset securities.”

In this lawsuit, cryptocurrencies SOL, BNB, BUSD, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI were classified as securities.

It is likely that the securities status will be removed from these cryptocurrencies, paving the way for a Solana ETF.

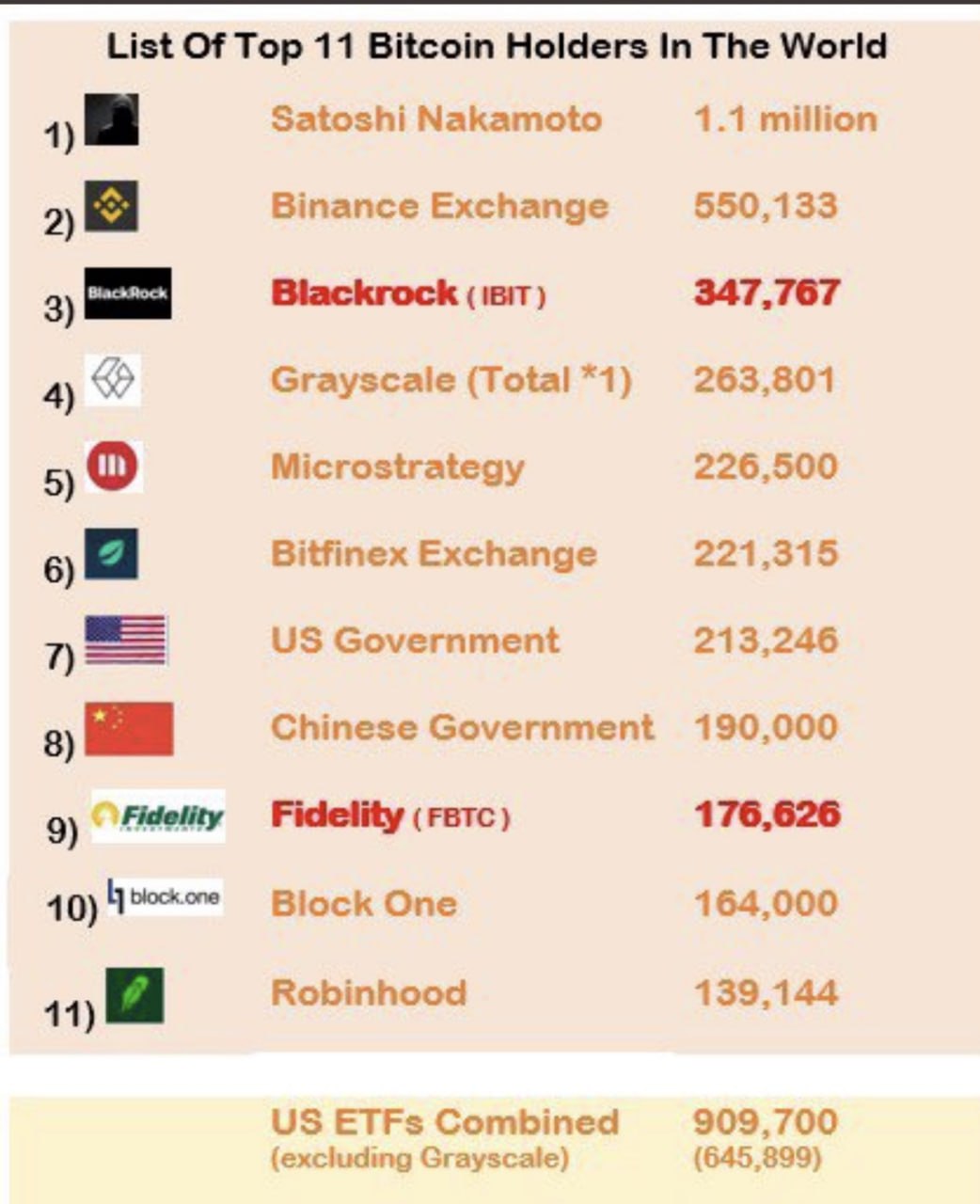

However, it is worth noting that BlackRock plans to focus exclusively on Bitcoin and Ethereum ETFs in the near future, with no plans for expansion. Therefore, the launch of a Solana ETF will be handled by VanEck, Grayscale, and other funds with less influence.

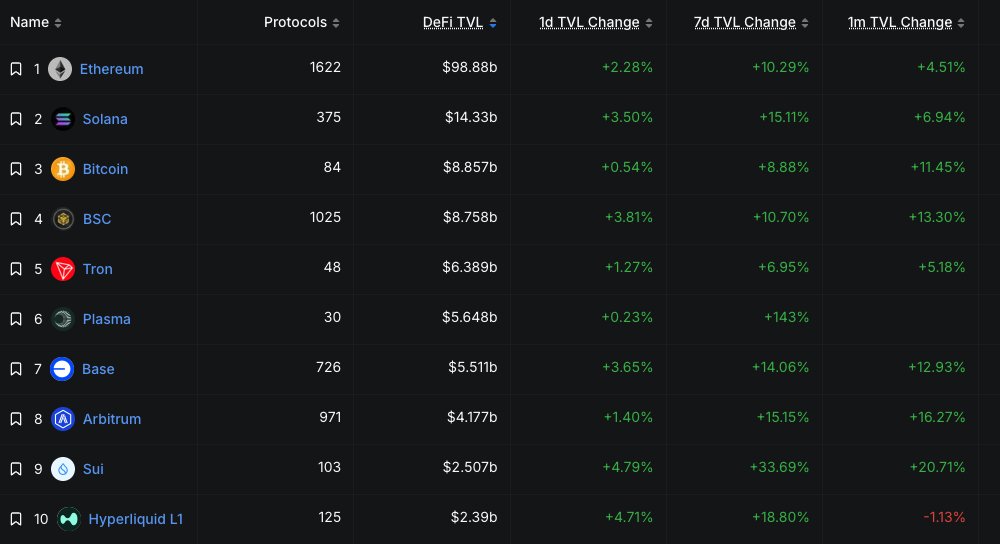

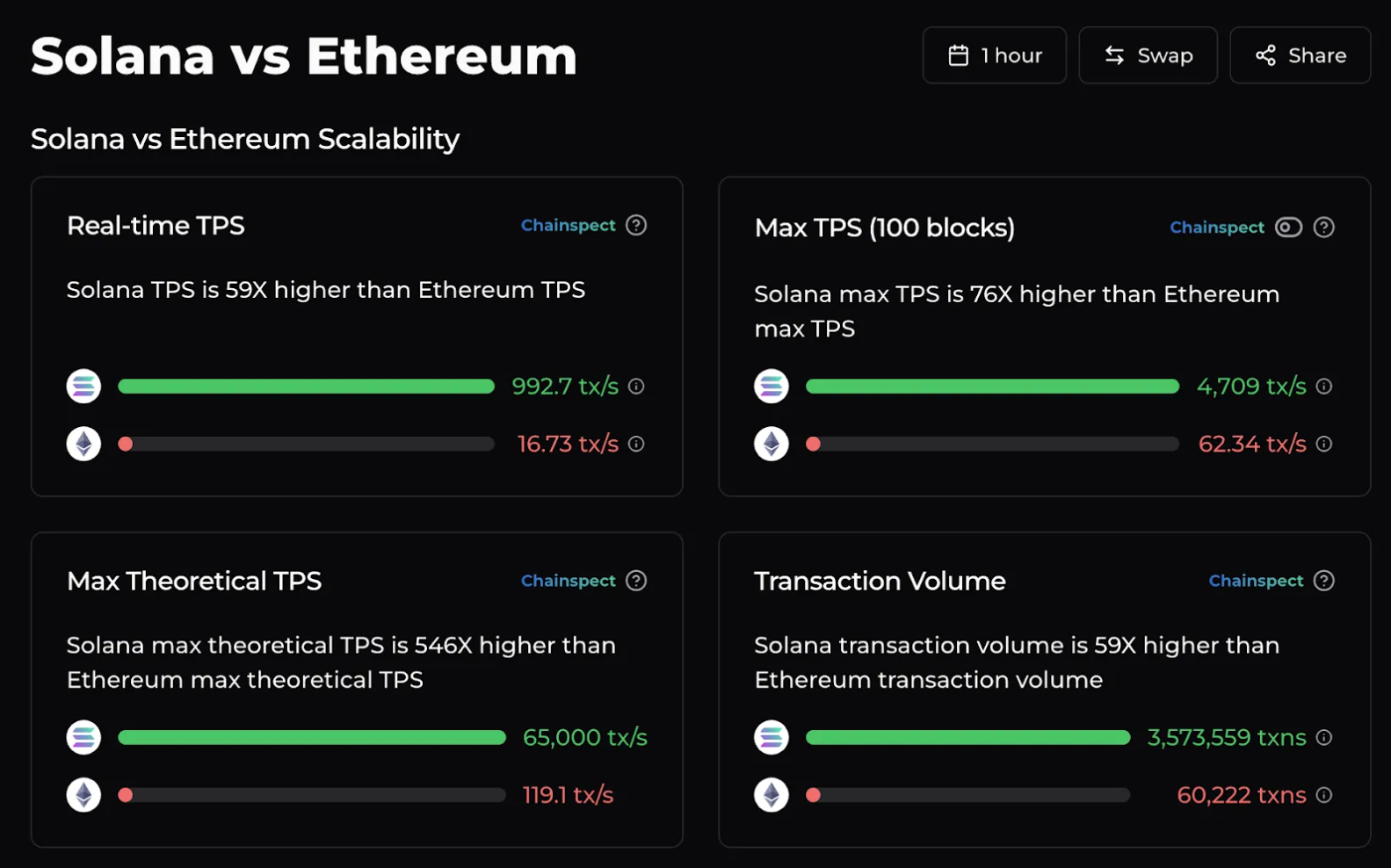

The launch of a Solana ETF could bring significant benefits to investors. SOL is one of the fastest-growing cryptocurrencies due to its high transaction speeds and low fees. This makes it attractive for decentralized applications and projects, which in turn increases investor interest.

Additionally, the launch of a Solana ETF could help legitimize the cryptocurrency in traditional financial markets, attracting new investors and increasing liquidity. This could also contribute to price growth for SOL and the overall development of the Solana ecosystem.

Nevertheless, investors should closely monitor the news and analyze the risks associated with potential regulatory changes and market volatility before making investment decisions.