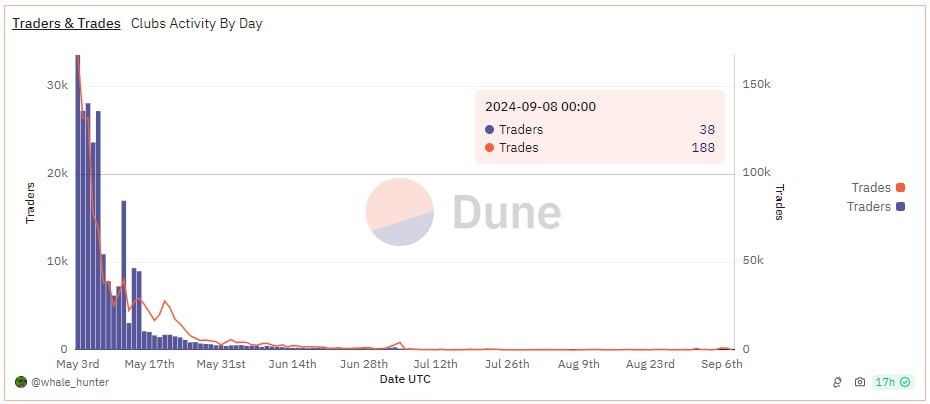

Bitwise CIO Matt Hougan expects Solana to overtake Ethereum as the core infrastructure for stablecoins and real-world asset (RWA) tokenization thanks to high throughput and near-instant finality. Bitwise is doubling down on the Solana ecosystem, but there are strong counterarguments and ongoing skepticism among some institutions.

Why Solana

In a conversation with Solana Foundation’s Akshay BD, Hougan called the network “the new Wall Street,” noting that stablecoins and RWAs look like the most tangible use cases for traditional investors:

“Bitcoin feels too abstract to them, but stablecoins and tokenization are things that will matter enormously.”

According to Hougan, Solana’s ace is performance: finality today is measured in hundreds of milliseconds with a target of ~150 ms. That latency and throughput profile aligns with the “instant” settlement expectations of Wall Street traders and infrastructure providers.

Counterarguments: Metrics and Scale Effects

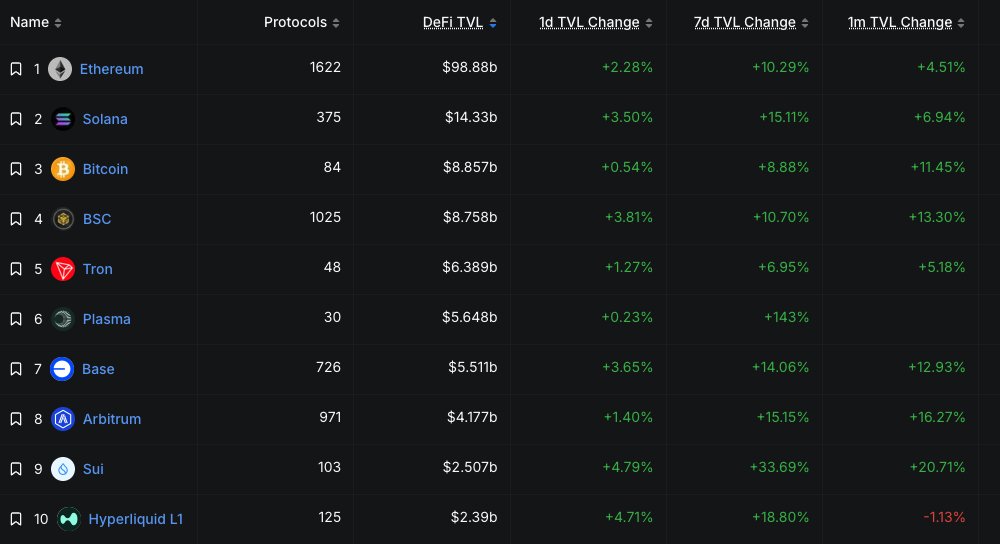

Offchain Labs’ Chief Strategy Officer AJ Warner counters that Ethereum’s DeFi liquidity (TVL) lead is massive—much larger than the gap between Solana and any other network. His takeaway:

“TVL isn’t the only metric, but it’s hard to doubt where it’s best to launch new stablecoins today.”

At the time of discussion (per DeFi Llama), Ethereum held about 53.7% of the stablecoin market (~$160.8B), while Solana had around 5% (~$14.9B).

How Bitwise Is Increasing Its Solana Exposure

- At Token2049 in Singapore, Bitwise CEO Hunter Horsley suggested Solana could surpass Ethereum in staking-enabled ETFs thanks to faster asset unbonding.

- The company already offers a Bitwise Physical Solana ETP (with physical SOL custody), though AUM is modest at about $30M.

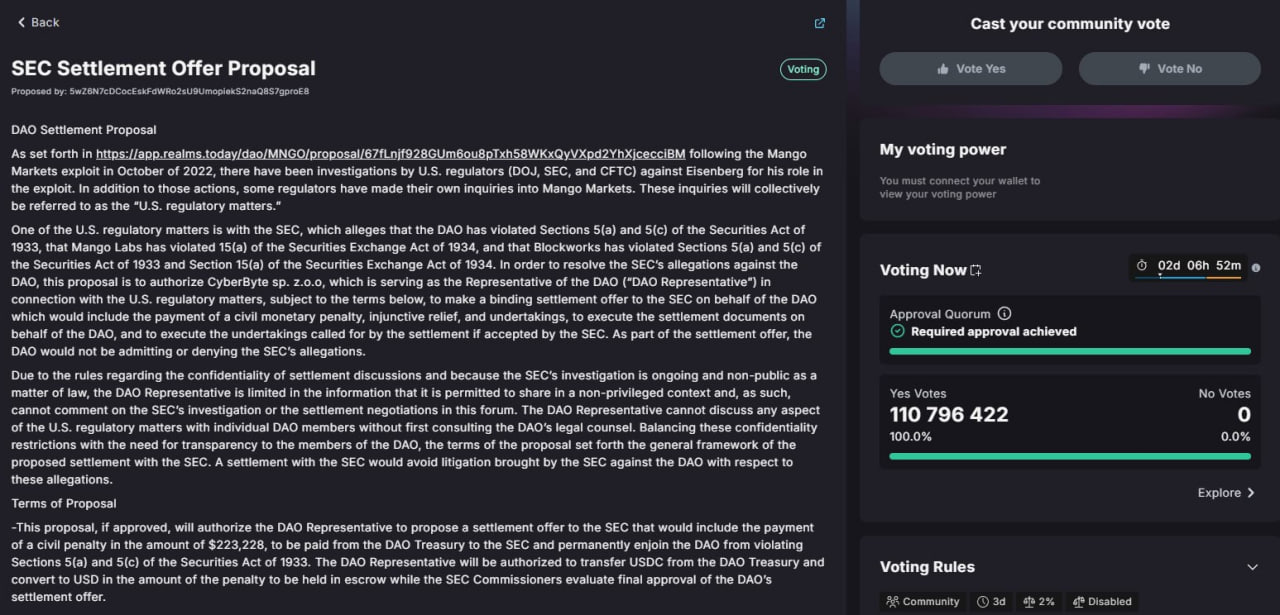

- Bitwise is also awaiting SEC approval on a spot Solana ETF.

Alpenglow: The Upgrade That Could Change the Game

According to a VanEck report dated October 3, Alpenglow is the largest consensus upgrade since Solana’s launch. Highlights:

- ~150 ms finality: aiming to bring confirmations closer to exchange-grade SLAs.

- Off-chain voting and a Validator Admission Ticket: simpler validator operations and lower costs.

- +25% block capacity: higher throughput.

- Firedancer (end of 2025): an alternative high-performance client to boost scalability and resilience.

- P-tokens by Anza: up to 95% less compute for execution.

- Rotor and local signature aggregation: stability even with up to 40% of validators offline.

Together, these improvements strengthen Solana’s positioning for DeFi, gaming, and tokenized assets, potentially making it more attractive for institutional use cases.

Skeptics’ View

In May, experts at Swiss crypto bank Sygnum said they still don’t see convincing evidence that Solana will displace Ethereum in institutional preferences. Ethereum retains advantages in ecosystem depth, liquidity, and tooling maturity.

What It Means for the Market

- Short term: Ethereum remains the de facto standard for stablecoins and DeFi liquidity; expect most new assets to debut there.

- Mid term: If Alpenglow and Firedancer deliver as promised, Solana gains a strong edge for RWA and payment-heavy use cases.

- Long term: Competition may split by sector: Ethereum for “heavy” liquidity and institutional standards; Solana for latency-sensitive, high-throughput products.

Bottom line. The “Solana for Wall Street” narrative is evolving from a slogan into a strategy—reflected in Bitwise’s product lineup and Solana’s roadmap. But a leadership change in stablecoins and RWAs is still a stretch away, constrained by Ethereum’s current liquidity lead and institutional caution.