The first US spot exchange-traded funds backed by Solana have gone live — and the launch is objectively stronger than most expected. According to SoSoValue, net inflows in the (incomplete) first trading week reached $199.2M.

who actually brought the money

There are only two products on the market right now:

- Bitwise BSOL

- Grayscale GSOL (a conversion of an old trust, not a brand-new ETF)

Here’s the key point: $197M of the $199M came specifically from BSOL (Bitwise).

So the current demand is not “for Solana in general” — it’s for a specific access format with minimal friction. BSOL has 0% fee. GSOL does not.

how fast the “Solana in ETF form” share is growing

- cumulative Solana-ETF AUM: $502M

- that’s already ≈0.5% of circulating SOL

This is extremely fast absorption because Solana is not a “low float” asset.

For comparison: when Bitcoin ETFs launched, getting 0.5% of supply into ETF form took weeks.

this market is actually being traded

Average daily volume — about $60M.

Meaning: this is not “quiet OTC accumulation” — this is a real exchange instrument that is being traded, not just bought and parked.

one nuance almost nobody is discussing

both products actually stake the underlying SOL:

- Bitwise — 100% of the fund’s coins

- Grayscale — 77%

That means the ETF is not simply putting SOL on cold storage — it is making the asset economically active (staking yield ~5–8% APR).

So for an investor — especially institutional — this looks more like fixed income than pure directional speculation.

This is a major factor for pension flows / family offices.

industry reactions

Eric Balchunas (Bloomberg):

BSOL posted the biggest weekly inflow among all crypto ETPs — $417M — and ranked top-20 across all ETPs. Very strong debut.

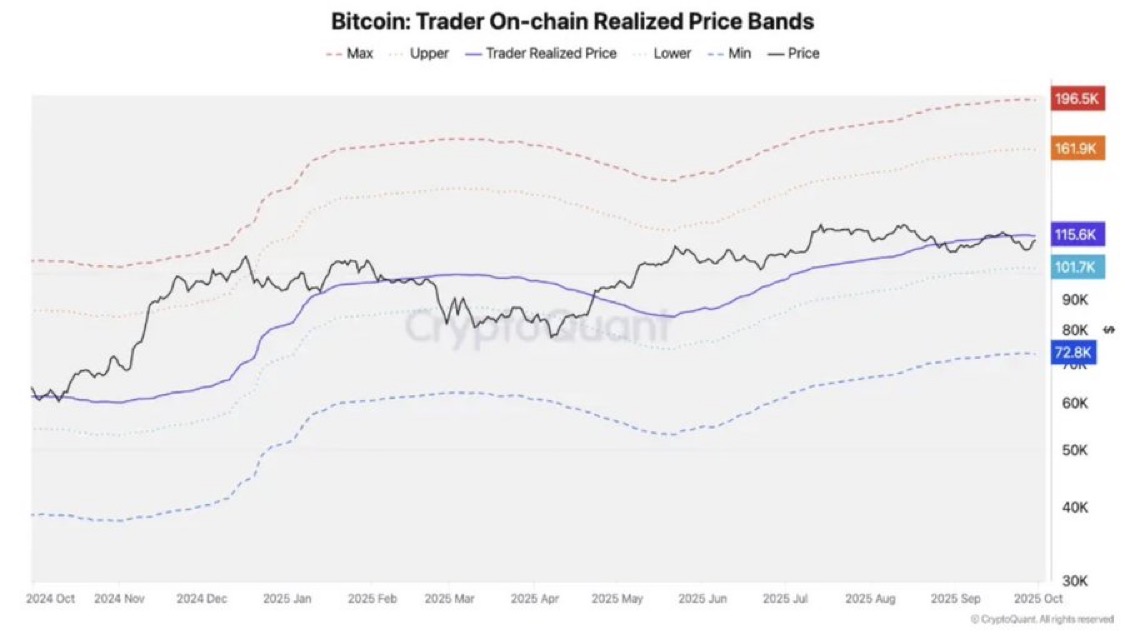

and the SOL price? paradoxically — zero euphoria

The token in the same week fell ~3.5% to $186.

The market is still repricing liquidity in the “core Solana economy” — on spot and in DeFi — and ETFs are currently perceived as a separate demand curve.

If Solana repeats the BTC ETF pattern, the market may “realize it” not instantly — but in 2–5 weeks.

“parallel launch” competitors

| ETF | weekly inflow |

|---|---|

| Hedera (HBAR) | $44M |

| Litecoin (LTC) | $0.719M |

So Solana captured almost all of the media attention.

Bitwise’s strategic hypothesis

Bitwise CIO Matt Hougan is explicit: Solana can repeat the Bitcoin arc.

Because Solana delivers general purpose functionality (smart contracts, DeFi, RWAs, AI infra) + high throughput.

If BTC today is “digital gold + ETF”, Solana is aiming to be “tech platform + ETF”.