Paricularly for financial markets, highlighting their growing significance in the global economy.

Experts pointed out that digital assets backed by fiat currencies play a key role in the global financial infrastructure. Stablecoin issuers, such as Tether and USDC, currently rank 18th among the largest holders of U.S. Treasury bonds, placing them right after Saudi Arabia and ahead of South Korea.

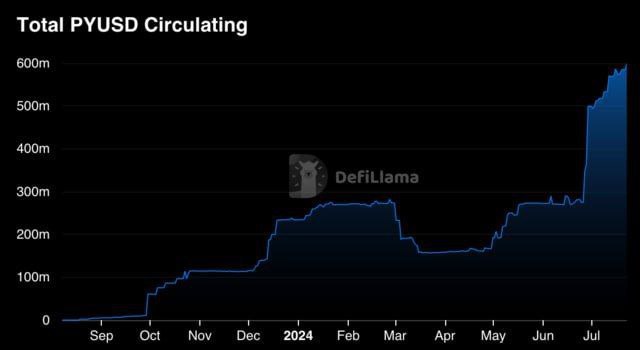

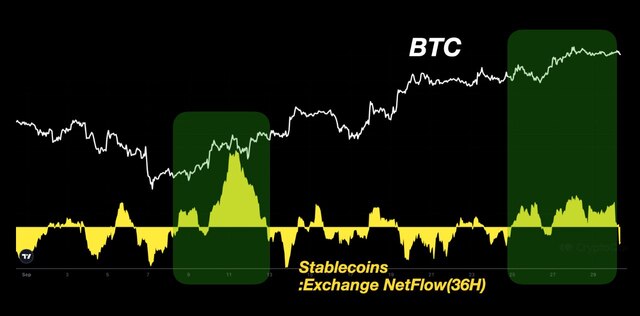

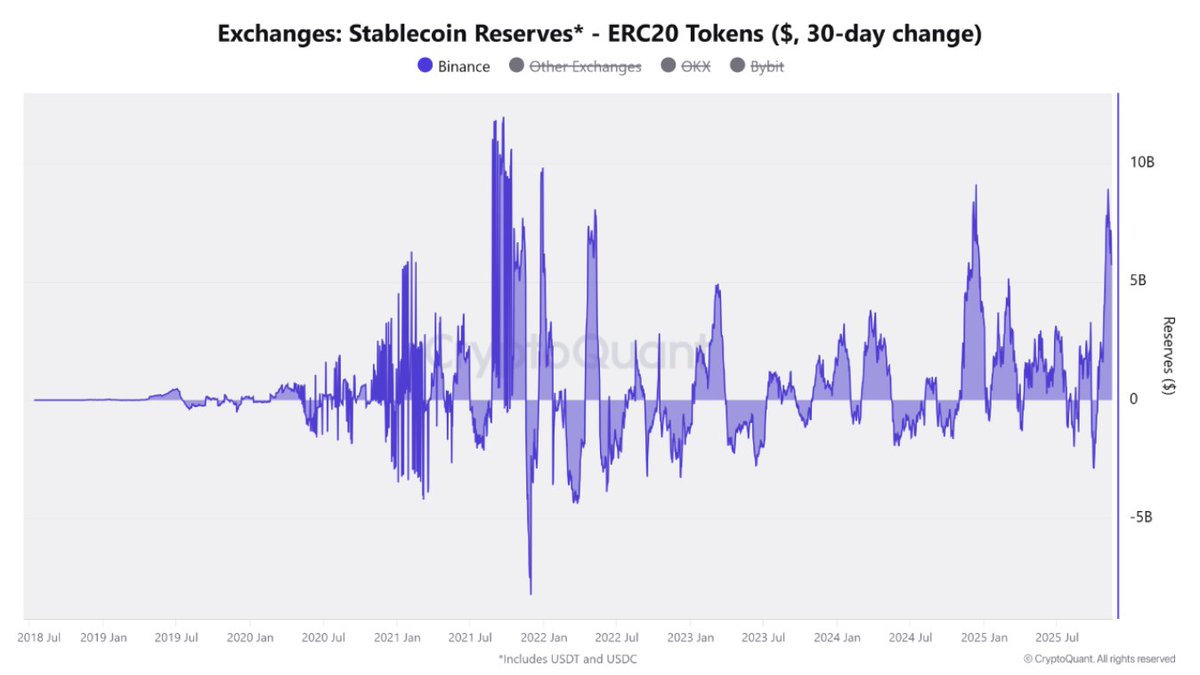

Over the past year, the monthly volume of transactions using stablecoins has tripled, reaching $1.4 trillion. Stablecoins now account for around 50% of all blockchain transactions, underscoring their importance in the digital economy. Analysts also note that stablecoins continue to evolve, gaining an increasingly prominent position in the global payment system, contributing to greater liquidity and market stability.

This rise of stablecoins may lead to increased regulation from central banks and governments, as they begin to recognize their impact on financial stability and monetary flows.