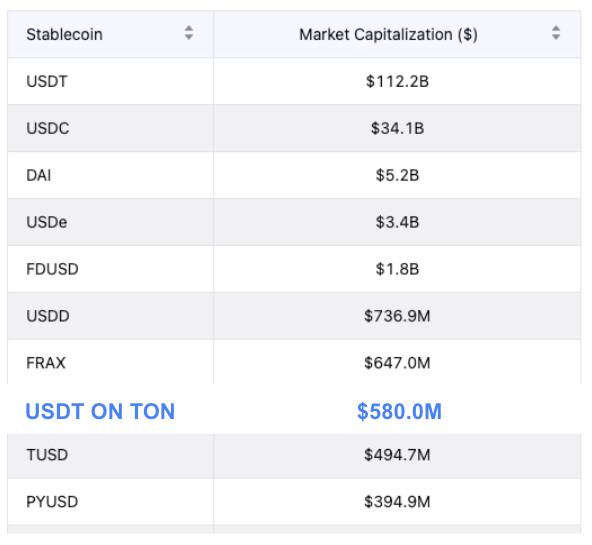

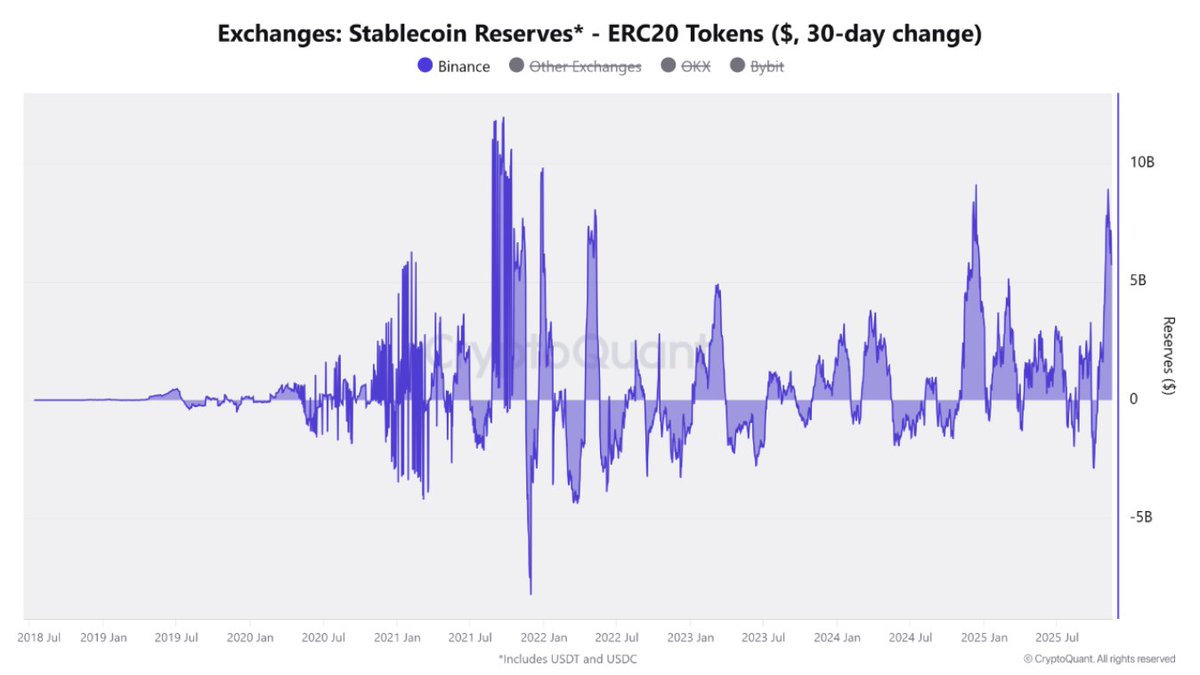

The Swiss Financial Market Supervisory Authority (FINMA) has stated that stablecoins increase the risks of terrorism financing and sanction evasion, while also posing reputational risks to the country’s financial system. These concerns are justified by the potential use of stablecoins for hidden financial operations that bypass traditional control systems.

To mitigate these risks, FINMA proposed classifying stablecoin issuers as financial intermediaries required to follow the same anti-money laundering (AML) rules as traditional financial institutions. This includes mandatory identity verification of stablecoin holders, monitoring suspicious transactions, and regularly reporting their activities to regulatory authorities.

Additionally, FINMA emphasized the importance of international cooperation in regulating stablecoins, as their transnational nature necessitates coordinated efforts from various jurisdictions for effective control and prevention of financial crimes. In the long term, this will help build trust in digital financial instruments and ensure the stability of the financial system.